HIPAA Compliance Checklist for 2025

Mergers and acquisitions (M&A) are accelerating across the software industry. In 2024 alone, global software M&A deals topped $230B, with SaaS companies leading the surge. But while the spotlight shines on valuations and synergies, the real challenge starts after the deal closes, integrating two complex SaaS ecosystems.

Overlapping tools, redundant contracts, shadow IT, and fragmented ownership can drain millions in wasted spend if not managed strategically. That’s why a structured SaaS M&A integration roadmap is critical, not just to control costs, but to unify governance, streamline operations, and maximize software ROI post-merger.

In this guide, we’ll outline a 6-step SaaS M&A integration framework, share proven tactics for discovering hidden SaaS, managing contracts, and aligning IT teams, and show how leading companies achieve 20–30% post-merger savings through automation and governance.

TL;DR – Your SaaS M&A Integration Roadmap at a Glance

1. Why a SaaS Integration Roadmap Matters in M&A

A structured roadmap is more than just a project plan, it’s a strategic advantage during mergers.

A. Reduce Redundancy, Costs, and Risk Across the Stack

Without governance, SaaS redundancy can waste up to 30% of software spend. Integration helps cut duplicate contracts, minimize compliance risk, and eliminate unnecessary complexity.

B. Drive Alignment Between IT, Business, and Leadership

Integration forces IT, procurement, and business units to align on application strategy, IT governance, and budgeting. This alignment ensures faster decision-making and less internal friction.

C. Maintain Innovation While Strengthening Governance

By consolidating wisely (not blindly cutting tools), companies can maintain innovation while strengthening oversight. The right roadmap balances agility with control.

2. Discovering Shadow IT Post-Merger

Shadow IT often spikes after a SaaS merger as employees adopt new tools to stay productive amid overlapping systems and shifting processes. With IT teams scrambling to integrate diverse tech stacks, employees may bypass official channels, creating untracked subscriptions and potential security risks.

This unchecked growth of shadow IT can lead to wasted resources, security vulnerabilities, and compliance gaps. Managing it post-merger is crucial for controlling costs, ensuring cybersecurity, and optimizing software investments.

a. Why Most SaaS Tools Go Untracked or Unreported

Many teams adopt tools independently because procurement cycles are slow, or because tools are billed to credit cards. These untracked apps can create security and compliance gaps.

b. The Role of Expense Reports and LOB Interviews

Analyzing expense reports and conducting line-of-business (LOB) interviews uncovers these hidden tools. Procurement and IT should work together to reconcile data sources.

3. 6-Step Roadmap for SaaS Integration During M&A

A clear roadmap prevents integration chaos. Here’s the structured 6-step process that high-performing CIOs and IT leaders follow:

A. Align M&A Teams with Business Unit Leaders

Integration success starts with alignment. Bring together M&A teams, IT leaders, finance, procurement, and business unit heads early. Define goals:

- What’s the timeline for integration?

- Which systems are critical on Day 1?

- How will governance be enforced post-merger?

Tip: Create a central SaaS integration task force to own the roadmap and make decisions fast.

B. Uncover All SaaS Applications Across Both Companies

Most post-merger surprises come from shadow IT. Before any consolidation happens, discover every SaaS tool in use across both organizations.

Methods include:

- Scanning expense reports and corporate cards

- Leveraging SaaS discovery platforms like CloudEagle.ai

- Interviewing line-of-business owners

According to Gartner, over 35% of SaaS applications in a typical enterprise are acquired outside of IT’s purview.

C. Document Use Cases and Utilization for Each Tool

Once you’ve mapped the full SaaS stack rationalization, document usage patterns and business use cases for each application. This helps distinguish between mission-critical platforms and niche tools.

Use a simple utilization table like this:

D. Assess and Address Application Security Risks

SaaS sprawl introduces serious security and compliance risks, especially when merging environments. Evaluate each app’s:

- SSO & MFA capabilities

- Data residency & compliance (GDPR, SOC 2)

- Integration points with core systems

Consider leveraging merger integration software or M&A integration tools to automate risk assessments at scale.

📊 47% of organizations experience a security incident within 12 months of M&A due to SaaS misconfigurations

E. Identify Opportunities for SaaS Consolidation

This is where the cost savings kick in. Post-merger, it’s common to find 10–20% cost optimization in tool overlap between two companies. By consolidating duplicate SaaS apps, you can generate media M&A integration savings quickly.

Examples:

- Two project management tools (Asana + Monday) → consolidate to one.

- Multiple cloud storage vendors → standardize on one platform.

- Duplicate marketing automation tools → pick the one with stronger integrations.

F. Build a Unified Integration Plan, App by App

With your SaaS landscape mapped and rationalized, develop an integration plan for each application category:

- Identity and Access

- Collaboration and Productivity

- Engineering and DevOps

- Finance and Procurement

Use post merger integration software to track dependencies, timelines, and milestones. Assign owners, communicate decisions, and ensure Day-1 business continuity.

4. How CloudEagle.ai Helps Uncover Hidden Applications

CloudEagle.ai plays a crucial role in SaaS management during mergers and acquisitions (M&A), streamlining the complex process of integrating various technologies and applications. Here's how CloudEagle.ai supports organizations in SaaS management during M&A:

A. Visibility into SaaS Stack

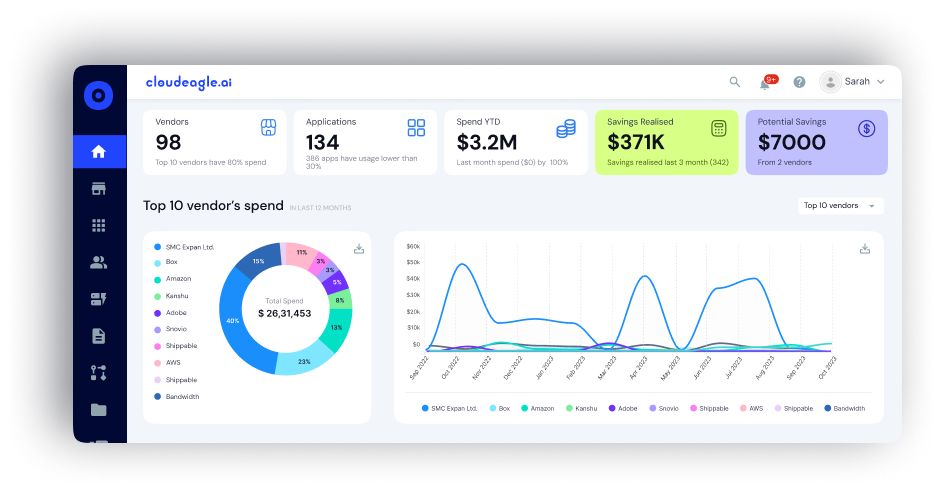

CloudEagle.ai provides complete visibility into all SaaS applications, uncovering tools that often go unnoticed during M&A. By tapping into SSO logs, financial data, and over 500 integrations, CloudEagle.ai ensures that no application is left behind. This helps in uncovering hidden applications, a critical step in ensuring that all tools are accounted for and that redundancies are identified.

B. Eliminating Redundant Applications

The tool identifies overlapping applications across both companies involved in the merger, helping reduce unnecessary software licenses. With its AI-powered discovery and license harvesting features, CloudEagle.ai helps eliminate unused tools and consolidate licenses, driving cost savings and simplifying the integration process.

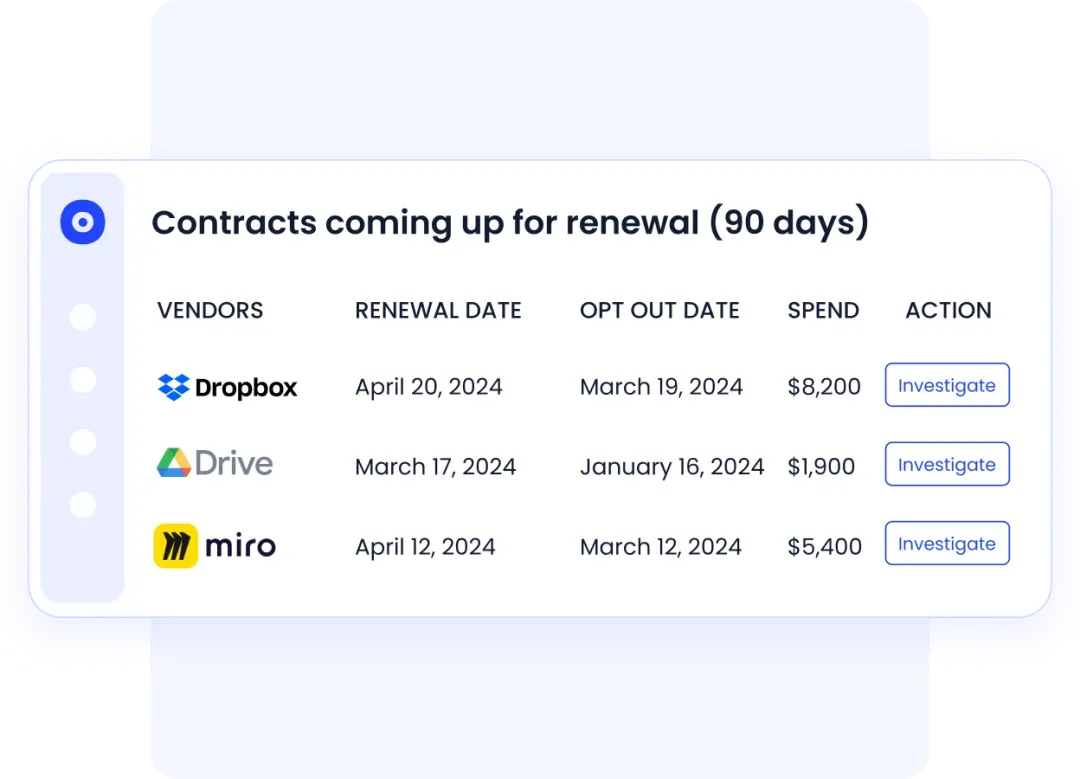

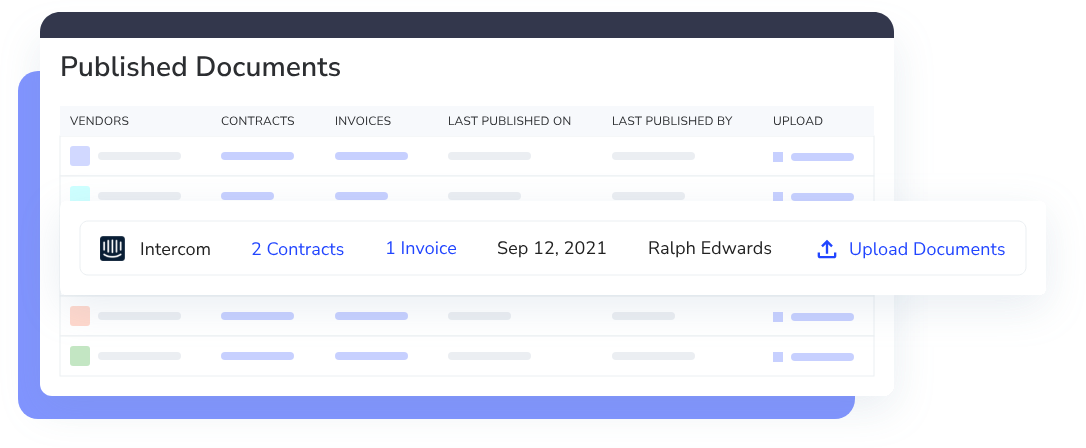

C. SaaS Contract Management

During M&A, managing SaaS contracts becomes crucial. CloudEagle.ai helps centralize contract information, conduct thorough audits, and identify opportunities for renegotiation. By leveraging its AI and contract management features, the platform ensures that SaaS contracts align with the new entity’s goals and helps streamline negotiations.

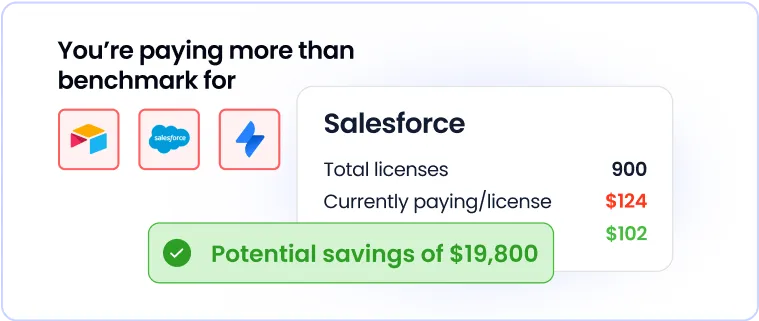

D. Optimization of SaaS Spend

CloudEagle.ai's cost optimization engine and SaaS benchmarking allow organizations to track their SaaS spending in real time, ensuring that they aren’t overpaying for unused tools. It helps businesses take immediate action to eliminate waste and optimize software investments post-merger.

E. Renegotiating Vendor Contracts

Key strategic vendors, such as Salesforce or Okta, are identified early in the M&A process. CloudEagle.ai helps businesses renegotiate contracts with these vendors to reflect the new combined volume, ensuring that the terms benefit the new entity.

F. Streamlined IT and Security Integration

CloudEagle.ai assists IT teams in managing SaaS applications through automated workflows, reducing the complexity of integrating new tech stacks and ensuring that security and compliance standards are met across both companies.

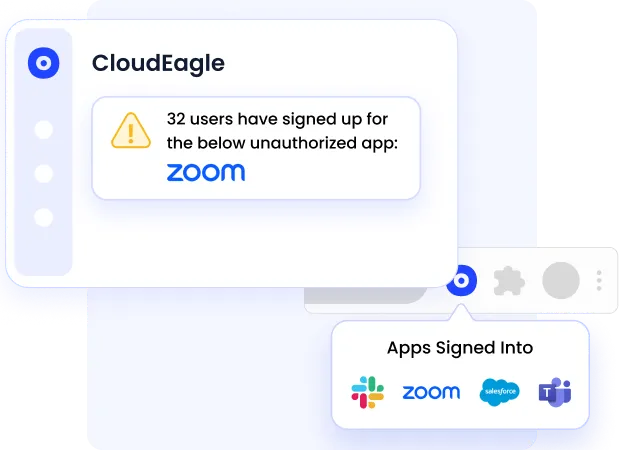

G. Prevention of Shadow IT

In the context of M&A, shadow IT is a significant challenge as employees from both companies may be using unapproved tools. CloudEagle.ai's shadow IT detection capabilities ensure that all apps, including those brought by employees, are discovered and managed, reducing security risks and compliance issues.

By automating many of the processes associated with SaaS governance, contract management, and optimization, CloudEagle.ai significantly reduces the operational burden during M&A, ensuring a smoother integration of software and technology.

5. Turn Integration Chaos into Strategic Advantage

M&A deals make headlines, but SaaS integration determines their success. By following this SaaS M&A integration roadmap, CIOs, IT leaders, and procurement teams can transform post-merger complexity into a strategic advantage, achieving faster synergies, stronger governance, and substantial cost savings.

CloudEagle.ai’s platform helps IT teams streamline and optimize every phase of the SaaS M&A integration process. With AI-powered discovery, automated governance, and actionable insights, CloudEagle.ai enables you to uncover hidden applications, eliminate redundancies, and ensure smooth integration across teams.

Ready to transform your SaaS integration strategy? Book a demo with CloudEagle.ai today and see how we can help you reduce costs, strengthen compliance, and unlock the full potential of your software investments.

Frequently Asked Questions

1. How much does M&A integration cost?

Integration costs vary, but SaaS M&A integration can consume 2–5% of deal value when unmanaged. A structured roadmap can cut this by up to 30%.

2. What are the benefits of post-merger integration?

Key benefits include cost savings, improved governance, reduced risk, and unified IT strategy. Many companies realize media M&A integration savings within the first year.

3. What are cost savings after a merger?

On average, companies achieve 10–30% software spend reduction through SaaS consolidation, license harvesting, and contract renegotiation.

4. What is M&A in cloud?

Cloud M&A involves integrating cloud-native and SaaS platforms post-acquisition to create a seamless technology ecosystem.

%201.svg)

.avif)

.avif)

.avif)

.png)